Calculating overheads and hourly rates is something that many business owners and consultants find challenging.

In my last blog post, we covered some tips and tricks on how to get your pricing right when preparing a quote for a NatHERS energy rating. In order to do that, I made some some assumptions about what my hourly rate should be, without really explaining how I arrived at that figure. In this blog post, I’ll talk more about how to calculate your hourly rate, and how this also relates to your expenses.

First and foremost, you need to decide how much you would like to earn. This of course is entirely up to you and the lifestyle you would like to be able to afford. As a starting point, let’s work off the average Australian income. According to the Australian Bureau of Statistics, in the 2016/2017 financial year this was $48,360 – let’s round this to $50,000 for simplicity.

Next, let’s think about how many hours you would like to work. For a full time employee this would be 38 hours per week, according to Fair Work Australia[2]. However, let’s say you only want to work three days a week so that you can spend more time with your family – that would be around 23 hours per week, which in turn would be around $42 per hour if you want to earn $50k per year.

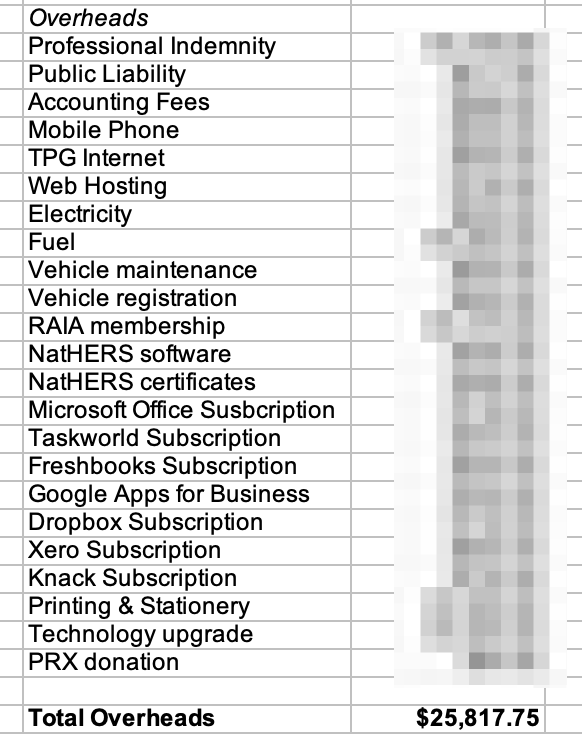

However, if we were to only charge $42 per hour for our time, this would only cover our salary, and not the other costs associated with running a business. So we also need to factor in our overheads and expenses. As an energy rater working from home, these could be minimal, but here’s some annual expenses we might need to account for:

- Professional indemnity insurance $1,000

- Energy rating software licence and certificate fees $1,000

- Other computer software $500

- Misc printing and stationery $500

- Internet access and mobile phone $1,000

We can call these our fixed overheads, because we have to account for these expenses every year, irrespective of how many jobs we may or may not have. In this example, our fixed overheads come to a total of $4,000.

Thus, to cover our salary and our fixed overheads, we would need to turnover at least $54,000 per year. This means we would actually need to charge around $45 per hour to cover the cost of salaries and overheads. The percentage difference between the cost of salaries alone compared to salaries plus expenses is known as the overhead factor. In this instance 45/42 = 1.07 which is an overhead factor of 7% ie. for every hour of billable time, 7% of the cost goes towards covering overheads and expenses. The remaining 93% is just for salaries. Other businesses that may require a lot of specialist equipment might have higher overhead factors of 50% or more.

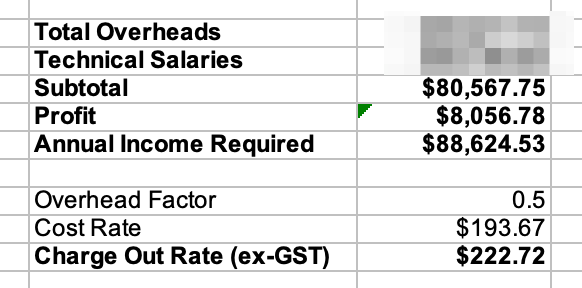

Figure 1. An example of an overhead factor calculation.

It would also be good business planning to allow a contingency for unexpected expenses (maybe 5%) and a profit margin of say 15% to help provide some financial buffer for when business is slow. Adding 20% this would increase our total turnover to $64,800 or around $54 per hour as the charge out rate.

There are other financial obligations you would need to cover as well, such as superannuation (9.5%) and other tax liabilities such as GST (10%), income and/or company tax. These amounts can vary considerably depending on how your business is structured, and you’d really need the advice of an experienced accountant or business professional as to what structure would best suit your business. For a business like mine, I find allowing around 30% extra to cover tax liabilities is generally sufficient.

That brings us to an additional allowance of around 50% which would increase our hourly rate to around $81 per hour. As you can see, there are a lot of “hidden or little” expenses that quickly add up and need to be factored into your hourly rate – it’s more than just the amount you would like to earn per year, divided by the numbers hours of work. If you don’t make appropriate allowances for these considerations, your actual net income can be quickly eroded, and before you know it you may even be operating at a financial loss.

It’s a really good idea when calculating overheads and hourly rates to set up a simple spreadsheet that calculates the various figures outlined in this article. That way you can see what kind of effect changing these numbers can have on your business – for example, you can see what happens if the cost of energy rating certificates go up, or what it would cost to add another person to your business.

Figure 2. An example of some overheads in my business. All of those small expenses can quickly add up!

If you combine these hourly rate calculations with the fee estimating techniques I discussed in my last article, you can then also work out how many jobs you might need to win/complete each month to ensure your income target and expenses are covered. You may then need to adjust your income, hourly rate and/or number of hours worked in response to market demand or other competition.

This article describes just some of the obvious things you need to allow for when calculating your hourly rate – you can obviously go into a lot more detail with regards to your expenses and overheads. I have a spreadsheet which I update every financial year, so I can see how my expenses change over time, and also helps me to work out if/when I need to increase my hourly rate.

One last thing – most states and territories in Australia have a government funded small business development agency/centre that can provide valuable advice and/or information seminars – they are often low cost and sometimes even free. I recommend you find yours and make contact with them. You’ll learn even more about how to calculate business expenses and overheads, and ensure your business is profitable.

Do you have some business tips to share or other advise on how to calculate your hourly rates and expenses? Please share your thoughts and comments below, so we can all learn together!